We have to admit that we rather enjoy jumping on the dogpile of crypto fans

A crypto hodler, crypto investor, and crypto analyst are in front of your house… how do you get them off your porch?

— Pay them for the pizza, cancel the Uber, and ask them to leave the Instacart bags. —

Crypto prices are crumbling but bitcoin continues to stay around $20K. It is just astounding that the price for a line item on a digital spreadsheet made of 1s and 0s of code is still that high. Even so, many “miners” (where are the pickaxes, sledge hammers and hard hats?) are crumbling as spiking electricity prices and lower hash prices (i.e. lower crypto prices) cut into the hodl fantasy business model.

BTC’s price has fallen about 56% year to date, and the sky continues to fall for various crypto and bitcoin miners. Unfortunately one of the causes is higher electricity prices, which also affects those of us in the real world that appreciate history, tangibility, and stability. Furthermore, the global recession is looming while inflation catches up with all the money the Fed printed the last few years and the unnatural interest rate they suppressed to make up for the 2008 financial collapse while they reloaded bankers’ pockets.

GET THE BEST ELECTRICTY FOR YOUR BUSINESS

We FORCE electricity companies to compete! Electricity providers will offer a lower price to us because they know they are competing for the business. This drives your price down!

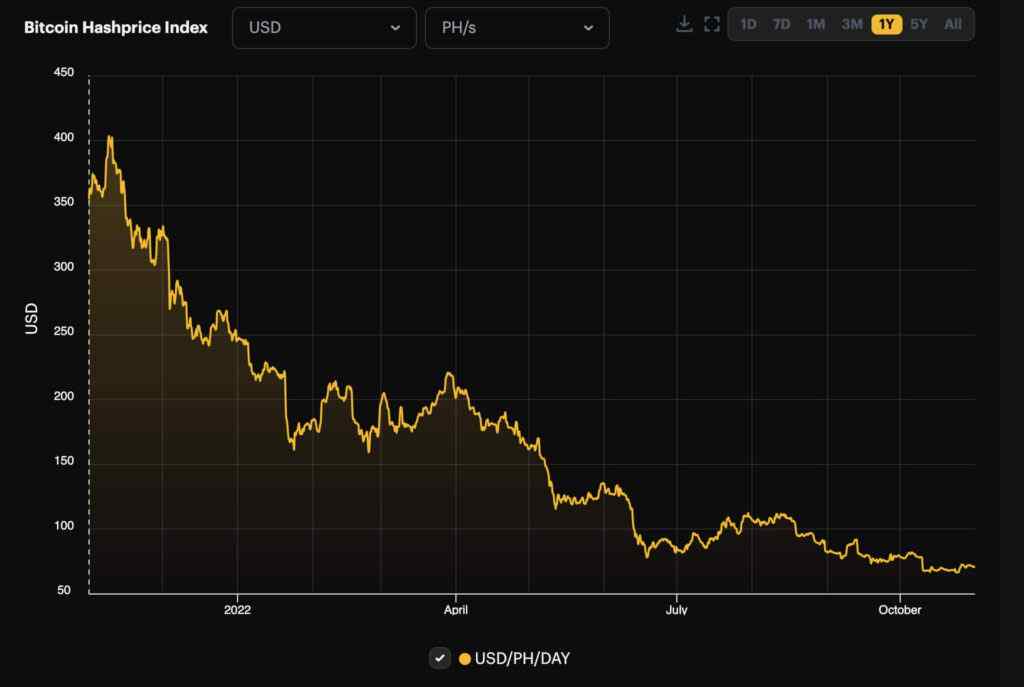

Hash price is a metric to determine the market value for each unit of hashing power, which is set through changes in bitcoin mining difficulty (which is currently high) and the price of the cryptocurrency. At a high level, the higher the hash rate the greater the difficulty to mine bitcoin — meaning that it takes more electricity to do so. If the electricity price is high, it’s harder to make a profit when they try converting imaginary money back into USD. Who’d a thunk it!

The hash price is near a historical low, and it is about $70.72, down 80.5% from $361.82 a year ago. Additionally, energy prices have increased across many markets, which means miners’ expenses are at all-time highs.