Wizard Energy puts the electricity market in context with real-time information

In Texas, Electricity rates don’t doesn’t exist in a vacuum outside of the whole energy market. To find the right electricity plan for your business (current and future needs), you need to know what is going on in the energy market now and how it will likely trend in the future.

Electricity Rates & energy Update September 2022

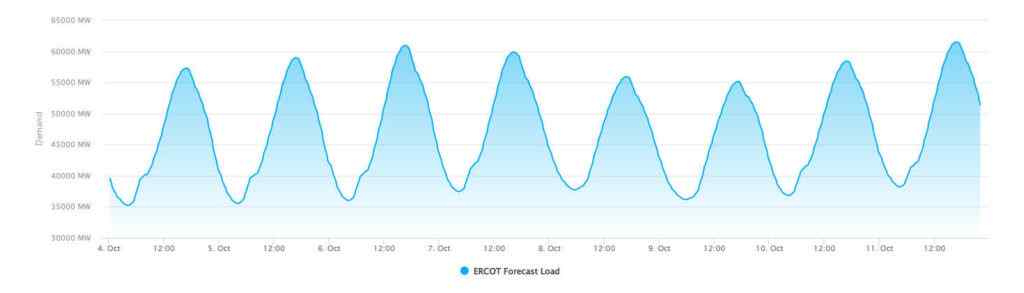

Winter weather is more weighted than normal this year because demand is outpacing growth in supply of natural gas and that is affecting power prices.

Natural gas production is up about 3.784% from 2021, but most of it was consumed by LNG (export) and electricity generation demand. Meanwhile, natural gas consumption is likely to be at its highest level on record and exceed 2019 levels, per the EIA. Consumption is projected to be up 4.337% from 2021 levels. As is often the case, the biggest factor affecting power energy and electricity prices will be winter weather.

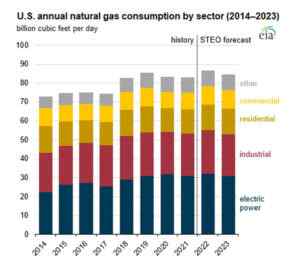

U.S. natural gas consumption likely to increase in all sectors

We expect U.S. natural gas consumption in 2022 to increase by 3.6 billion cubic feet per day (Bcf/d) from 2021 levels to average 86.6 Bcf/d for the year, the highest annual natural gas consumption on record. It looks like U.S. natural gas consumption will increase in all sectors, led by the electric power sector and the residential and commercial sectors.

In the electric power sector, which consumes the most natural gas, annual consumption has increased by 1.2 Bcf/d in 2022 to average 32.1 Bcf/d, which is 0.3 Bcf/d greater than the previous annual record high of 31.8 Bcf/d set in 2020.

When we get our electric bills, we all know this sector is sensitive to changes in natural gas prices relative to coal prices. Many power providers typically offset their use of natural gas with coal for electricity generation when natural gas prices are relatively high.

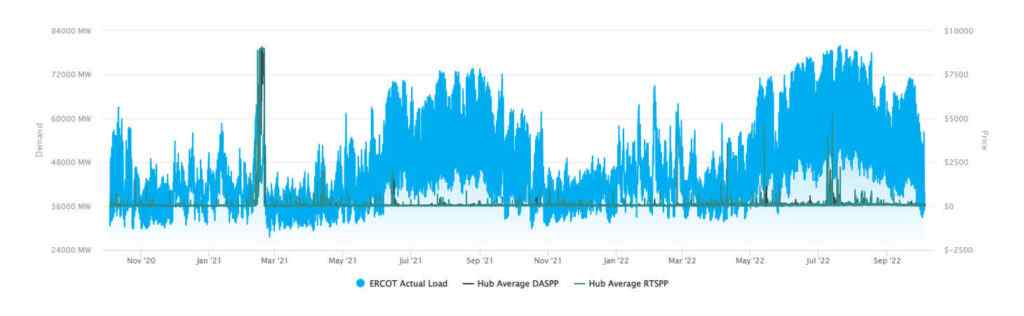

Impact on Electricity Prices

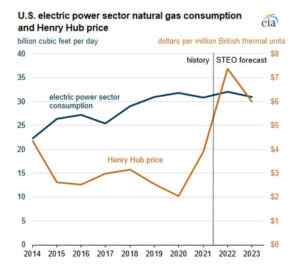

Despite a large increase in natural gas prices this year, U.S. consumption of natural gas in the electric power sector increased in the first eight months of 2022, averaging 33.2 Bcf/d, which is 2.0 Bcf/d higher than the same time in 2021 and 0.4 Bcf/d higher than in 2020. Over the same eight-month period, the natural gas price at the U.S. benchmark Henry Hub in Louisiana averaged $6.56 per million British thermal units (MMBtu) in 2022, compared with $3.43/MMBtu in 2021 and $1.86/MMBtu in 2020.

U.S. consumption of natural gas in the electric power sector has increased in 2022 due to limitations at coal-fired power plants and weather-driven demand. Coal-fired power plants have been limited in their ability to increase power generation due to historically low on-site inventories, constraints in fuel delivery to coal plants, and continued coal capacity retirements. During both a cold January and a hot summer, natural gas was key to meeting electricity demand peaks throughout the country. We expect natural gas consumption in the electric power sector to decline in the fourth quarter of 2022 and in 2023, in part, due to more renewable electricity generation capacity coming online.

Residential Consumption of Gas / Electricity

We forecast annual U.S. consumption of natural gas in 2022 to have increase by 0.9 Bcf/d in the residential sector and by 0.7 Bcf/d in the commercial sector, driven by high consumption in January. January 2022 was particularly cold, resulting in 9% more heating degree days (HDD) compared with the previous 10-year (2012–2021) average. Natural gas consumption in these two sectors averaged 8% higher than the five-year (2017–2021) average in January, averaging 31.0 Bcf/d in the residential sector and 17.8 Bcf/d in the commercial sector. We expect natural gas consumption in the residential and commercial sectors in 2023 to be similar to 2022 levels.